#DOUBLE ENTRY BOOKKEEPING PLUS#

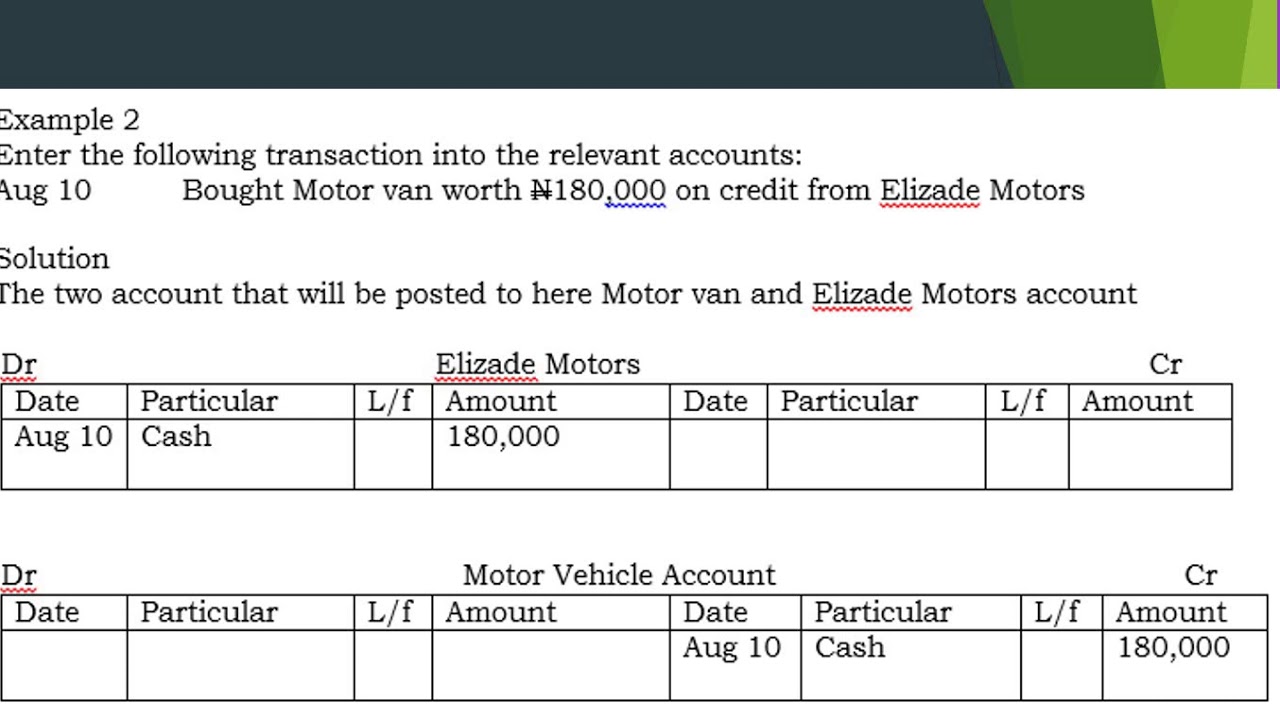

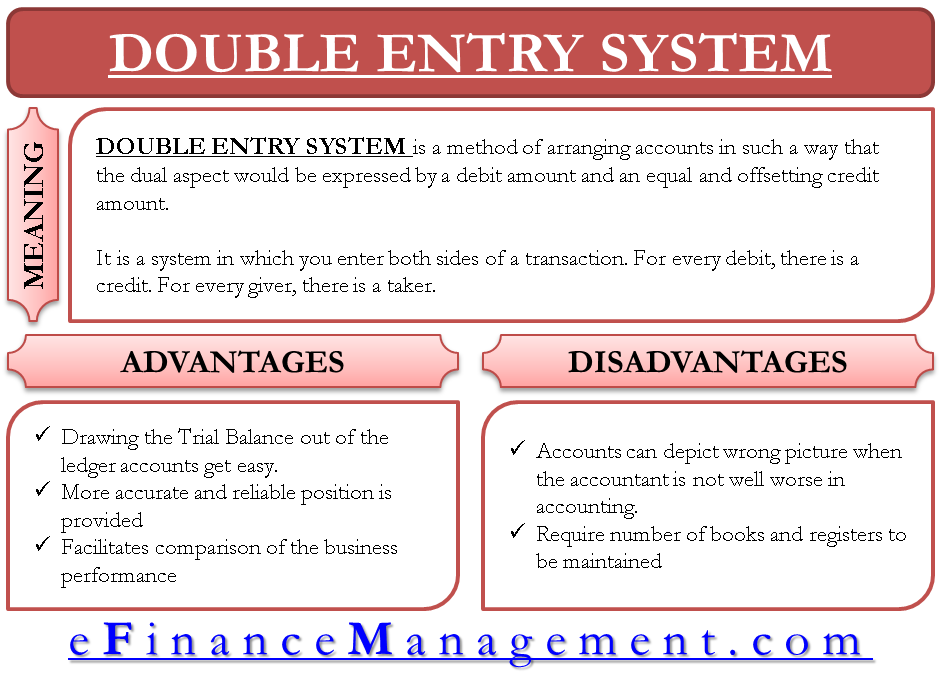

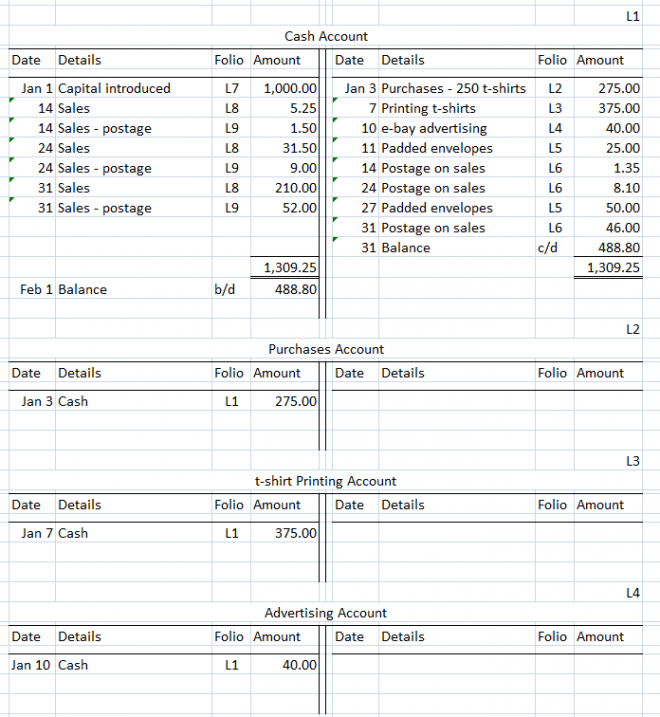

The accounting equation shows that liabilities plus equity are equal to your assets. Use the accounting equation to ensure your transactions are always balanced in your books. Keep in mind that debits and credits offset each other, and the sum of debits should be equal to the sum of credits. Check out this chart to see how each type of account is impacted: With double-entry in accounting, record two or more entries for every transaction.Ĭredits and debits affect each account differently. Record credits and debits for each transaction that occurs. If a debit decreases an account, you will increase the opposite account with a credit.Ī debit is an entry made on the left side of an account while a credit is an entry on the right side. Debits and credits are equal but opposite entries in your accounting books. To balance your books, use debits and credits. Both sides of the ledger should have equal balances. Liabilities, equity, and revenue are on the right side. Assets and expenses are on the left side of the ledger. The general ledger reflects a two-column journal entry accounting system. For example, you might use Petty Cash, Payroll Expense, and Inventory accounts to further organize your accounting records. You can also divide the major accounts in accounting into different sub-accounts.

Read on to learn what is double-entry accounting and how it can benefit your books.ĭouble-entry bookkeeping is an accounting method where you equally record a transaction in two or more accounts.

One way you can keep track of your finances is by using double-entry accounting. Recording transactions and keeping financial records are an essential part of owning a business.

0 kommentar(er)

0 kommentar(er)